FraudSentinel360

FraudSentinel360 is a comprehensive fraud case management platform designed specifically for the BFSI sector. It enables organizations to efficiently manage every stage of a fraud case—right from initial reporting, triage, investigation, legal action, committee review, to final regulatory reporting.

The solution is built in compliance with:

With structured workflows, centralized documentation, seamless collaboration, and automated regulatory report generation, FraudSentinel360 brings speed, control, and accountability to your fraud management operations.

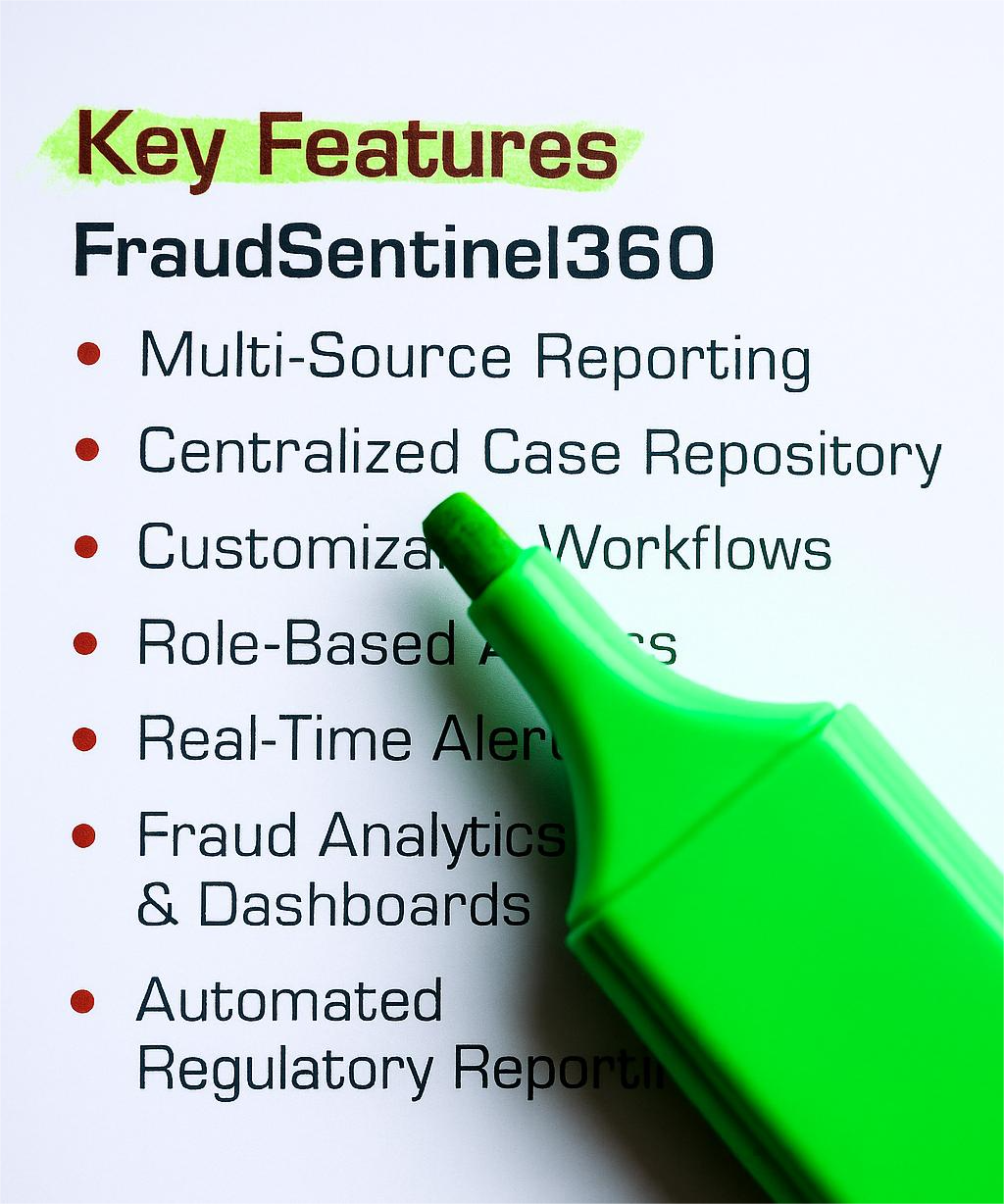

Key Features

Multi-Source Reporting:

Centralized Case Repository: All fraud-related data—evidence, documents, notes, and communication—is securely stored in a centralized repository with role-based access control.

Customizable Workflows: Define and automate investigation stages like “Reported → Under Review → Investigated → Closed,” with department-specific paths and visibility.

Role-Based Responsibility Mapping: Assign responsibilities to key departments—Legal, Compliance, Audit, Risk, Business—with department-wise turnaround times (TATs).

TAT Tracking & Escalations: Automatically track SLAs and escalate overdue actions to ensure accountability and timely resolution.

Real-Time Alerts & Notifications: Notify users instantly through email and in-app alerts for key events such as reassignment, approvals, and case closure.

Fraud Analytics & Dashboards: Interactive dashboards provide real-time insights into fraud types, trends, recurring patterns, and root causes—empowering leadership and audit committees.

Automated Regulatory Reporting: Generate RBI-compliant reports (FMR-1, FMR-2, FMR-3) along with internal reports for audit and board-level reviews—automatically and accurately.

Custom Module Integration: Extend the platform with modules like Notice Management, Third-Party Fraud Monitoring, or integrations with Core Banking, ERP, or HRMS systems.

Security & Compliance

ISO 27001 Certified

End-to-End Data Encryption

Full Audit Trails for Every Action

Role-Based Access Control

GDPR-Compliant Architecture

Deployable On-Premises or on Dedicated Cloud Infrastructure

Who Should Use FraudSentinel360?

Banks (Public, Private, and Cooperative)

NBFCs (Non-Banking Financial Companies)

Insurance Companies

Fraud Control & Vigilance Teams

Risk & Compliance Departments

IT & Security Teams